I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

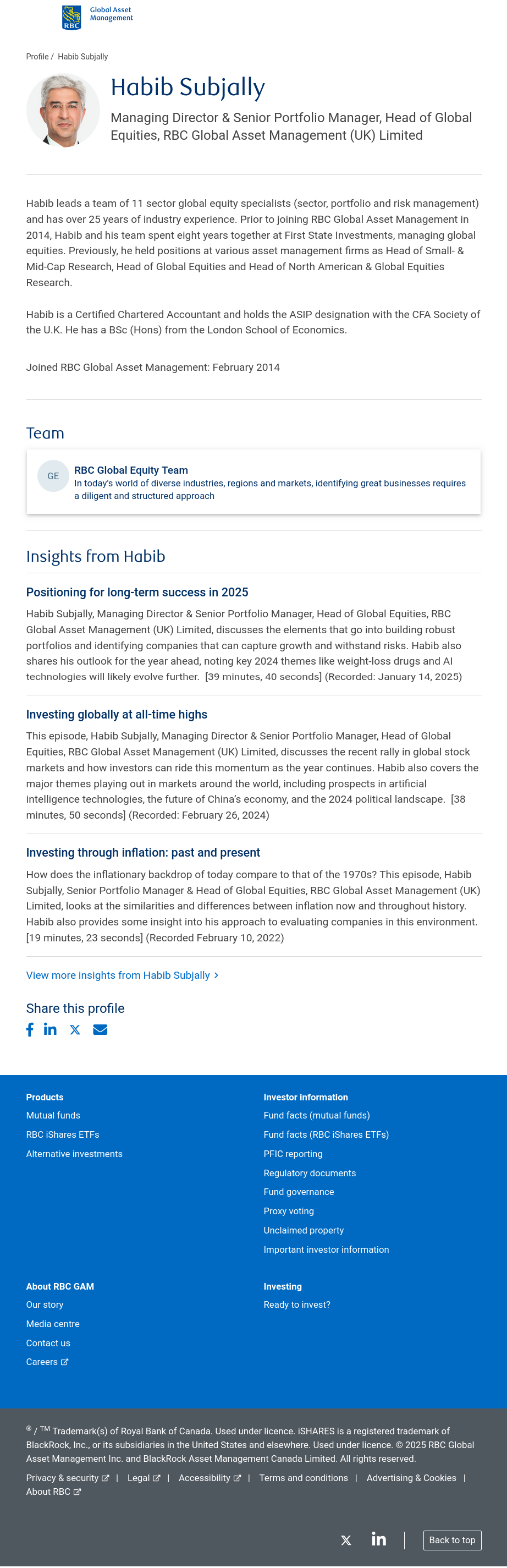

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

My fund is managed by that guy. I sold everything.

I avoid the stock market because I can’t find anything ethical to invest in. Particularly stocks that “perform” well are all variants of EvilCorp. So-called “Ethical Funds” all include companies that I wouldn’t consider ethical.

I think the most ethical thing to do is to help the most ethical companies trying to stay clean in a dirty economy. Surely there are good-enough ones in all countries and sectors. Makers of wind turbines, solar panels, batteries, cable, bicycles, electric vehicles (trains and trams!), etc. ASML, TSMC, Tuxedo, Fairphone, etc.

I agree with you and your examples generally, but then that sounds like “active investing” which I have neither the time nor the “risk appetite” for.

The activity can be limited, and so can the risk:

Once in about 5 years, buy a diversified portfolio of 30 companies in at least 10 countries on at least 2 continents in at least 3 unrelated industries, and forget for 5 years.

Maybe prefer to buy in a depression and sell on a bubble if you’re feeling extra active.

It’s easy nowadays through many banks’ websites. I use Nordnet.

Between stock sprees, save into a regular savings account.