I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

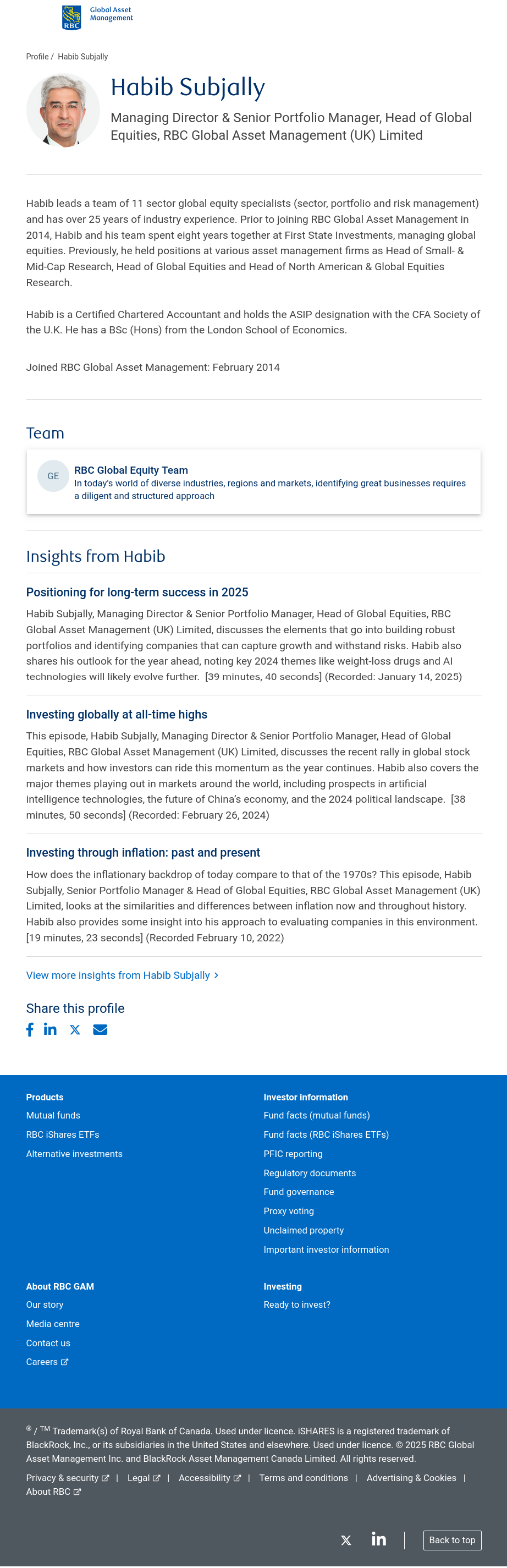

My fund is managed by that guy. I sold everything.

You need a fiduciary. Mine handles things like this, and gives me a yearly update on what I’m invested in. The two investment strategies I have her employing are primarily investments that help transition society to an ebviromentally sustainable model, and businesses that will have to clean up disasters waiting to happen.

Congratulations, you are invested in DISASTER CAPITALISM.

I avoid this by simply having no money

YSK I’m profiteering off of the masses thinking like this by not moving my money. It’s worked for me every time someone told me “you should reinvest”

That’s how the evil profit the most, and voting with your feet has limited effect. The correct solution is regulation and EU-mandated boycott.

This is why I just give my money to a professional whose sole job is to turn it into more money.

Usually index funds outperform active investors.

https://en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

https://www.cnbc.com/2020/11/24/heres-when-active-mutual-funds-tend-to-outperform-index-funds.html

- Investors generally fare better in index mutual funds and exchange-traded funds versus their actively managed counterparts.

- The average investor pays about five times more to own an active fund relative to an index fund. This makes it tougher for active funds to outperform index funds, after fees.

- However, the lowest-cost active funds tend to beat the average index fund in categories like junk bonds, foreign stock and global real estate.

I strongly dislike America so profiting off of their suffering is extra sweet. I even bought into UnitedHealth Group during the Luigi dip knowing Americans would forget all about it in a month or so and wouldn’t you know it the stock is bouncing back nicely.

The evil of the rich use your money to kill the innocent.

Americans are not innocent.

I promise you there are a lot of good Americans that dont want any of this shit., we are here we just have no fucking idea of what to do. They say vote better… well that didn’t work… protest?? Good luck protesting a police state. Any suggestions?

I know, I’m friends with many and have relatives who live there. Nevertheless, may you all burn in hell for what you have done. Not literally but that’s the vibe I’m on.

Maybe true, but we should blame those who made them that way with lifelong propaganda. Even if you wise up and do your best, tough luck being given FPTP voting and two evils to choose from.

I avoid the stock market because I can’t find anything ethical to invest in. Particularly stocks that “perform” well are all variants of EvilCorp. So-called “Ethical Funds” all include companies that I wouldn’t consider ethical.

I think the most ethical thing to do is to help the most ethical companies trying to stay clean in a dirty economy. Surely there are good-enough ones in all countries and sectors. Makers of wind turbines, solar panels, batteries, cable, bicycles, electric vehicles (trains and trams!), etc. ASML, TSMC, Tuxedo, Fairphone, etc.

I agree with you and your examples generally, but then that sounds like “active investing” which I have neither the time nor the “risk appetite” for.

The activity can be limited, and so can the risk:

Once in about 5 years, buy a diversified portfolio of 30 companies in at least 10 countries on at least 2 continents in at least 3 unrelated industries, and forget for 5 years.

Maybe prefer to buy in a depression and sell on a bubble if you’re feeling extra active.It’s easy nowadays through many banks’ websites. I use Nordnet.

Between stock sprees, save into a regular savings account.

In all seriousness, perhaps consider Bitcoin - it has a ~60% ARR since inception and is nation-state agnostic.

Crypto money is a waste of computation that could be used for something productive, like protein folding.

When investing in (most) companies, the money buys means of production for making a product someone can use. I like that.

Fair enough, you might like a Proof of Stake coin like Ethereum more